Introduction: Recently, affected by the sharp drop in raw material TMA, which has led to a significant reduction in costs, the domestic TOTM market price has continued to fall, once again setting a new market low. As of May 16, the reference price of TOTM in East China was 16,000-16,200 yuan/ton.

1. TOTM market prices continue to hit new lows

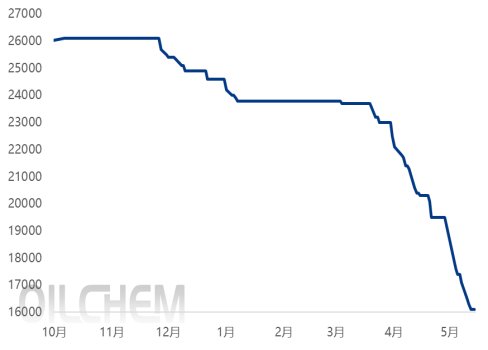

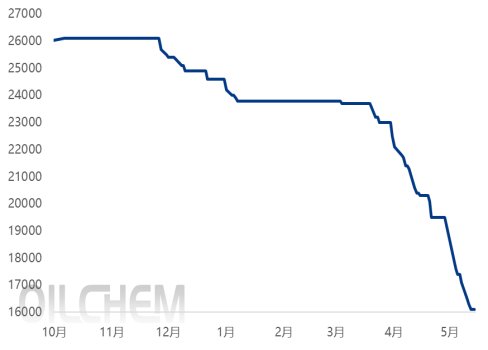

Figure 1 Domestic TOTM price trend in East China (yuan/ton)

As of May 16, the reference price of TOTM in East China was 16,000-16,200 yuan/ton, down 3,400 yuan from April 27, a drop of 17.44%. Recently, the domestic TOTM market price has continued to fall, the overall market trading atmosphere is sluggish, and the wait-and-see atmosphere is increasing. It is reported that the market price of the main raw material TMA has fallen sharply, while the raw material octanol has fallen slightly, so that the cost of TOTM has dropped significantly, the cost pressure has weakened, and the support for its market price has also dropped to a low point. In addition, due to the sharp drop in raw material prices, the market has become more bearish, so that the downstream demand for its raw material TOTM is poor, the overall operation is cautious, and the purchase is mainly based on rigid demand, and the inquiry and transaction volume are bleak.

Table 1 Summary of TOTM and raw material prices (unit: yuan/ton)

product | market | April 27 | May 16 | Rise and fall value | Rise and fall |

TOTM | East China | 19500 | 16100 | -3400 | -17.44% |

Focus on upstream |

TMA | East China | 36000 | 25000 | -11000 | -30.56% |

Octanol | Shandong | 7475 | 7450 | -25 | -0.33% |

Data source: Longzhong Information

2. The raw material market fell sharply. TOTM cost support declined

Table 2 Summary of TOTM cost-profit trend (unit: yuan/ton)

product | market | April 27 | May 16 | Rise and fall value | Rise and fall |

cost | East China | 18476 | 14504 | -3972 | -21.50% |

profit | Shandong | 1024 | 1596 | +572 | +55.86% |

Data source: Longzhong Information

As of May 16, the cost of TOTM was around RMB 14,504/ton, and the profit was around RMB 1,596/ton. Compared with April 27, the cost decreased by RMB 3,972/ton, a decrease of 21.5%. This was mainly due to the sluggish market buying atmosphere for the raw material TMA, the bearish outlook in the downstream, and the dismal demand for it. As a result, TMA factory shipments were hindered, inventory levels continued to increase, and sales pressure increased, resulting in continuous and substantial concessions on shipments. As a result, the market price of TMA fell by RMB 11,000/ton, and the cost of TOTM was greatly reduced. As a result, the cost support for its price continued to weaken.

3. Market Forecast

Supply side: TOTM factory operation is relatively stable, early inventory levels have increased, and market supply is sufficient.

Demand side: Downstream demand is weak, and purchases are mainly made on dips to meet basic needs .

On the whole, domestic TOTM factories encountered difficulties in shipping in the early stage, and inventory levels increased. In addition, the raw material market fell sharply, and the cost support was weak. In addition, the downstream bearish atmosphere was heavy, and the demand for its raw material TOTM was bleak. Therefore, the market supply exceeds demand situation, and the TOTM market is expected to fluctuate and run weakly in the future.